by Michael Roberts

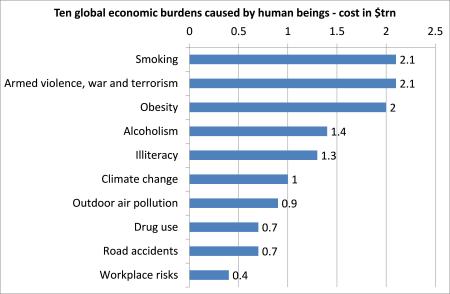

A recent estimate was made of the economic cost of varied human

action globally. The annual economic burden of smoking on health

services, shortened life expectancy and illness was found to be the

greatest at $2.1trn a year, closely followed by the losses from wars and

armed violence around the world and by obesity.

These burdens are not just from ‘human action’ but really come from the crimes and waste of capitalism: tobacco companies promoting cigarette smoking, wars provoked by imperialism and nationalism; food companies selling ‘affordable’ junk food with high concentrations of sugar, salt and fats – and of course global warming and climate change.

But one economic burden not recorded in this list is the waste from economic recessions and depressions. The loss of jobs, incomes and assets like homes is no small beer. And the longer the slump, the greater the loss. This is a hidden crime of capitalism.

The current ‘recovery’ from the Great Recession of 2008-9 has been so weak and so drawn out that the overall loss of value compared with potential output if there had been no slump and/or a quick recovery is huge – probably close to $10trn over five years for the US alone. That ‘damage’ easily matches the damage from smoking over the last five years.

|This crime of capitalism is ignored by mainstream economics. For example, Robert Lucas is a Nobel prize winner and leading exponent of the view that modern capitalism is an efficient manager of human resources and the output of labour. He is infamously quoted as saying in 2003, that the problem of depressions had been solved by modern mainstream economics (http://thenextrecession.wordpress.com/2010/05/28/vulgar-economics-in-despond/). In 2010, he argued that there can be ‘shocks’ to the steady equilibrium growth path of capital investment, but they would usually be temporary. Very quickly, growth would return to its previous trend (http://danieljmitchell.wordpress.com/2011/06/16/nobel-prize-winner-analyzes-the-obama-growth-gap/).

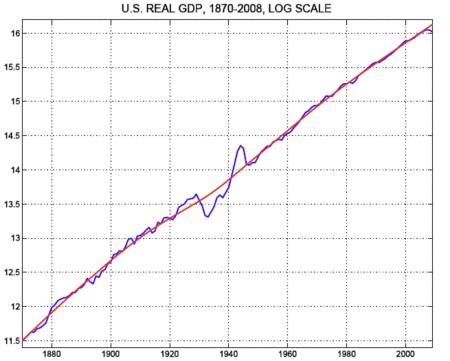

Lucas presented the following chart of US economic growth over the last 140 years. The red line represents trend economic growth and the blue line shows the actual growth rate. In this bird’s eye view, growth has been inexorable and mostly pretty much along the equilibrium trend path.

Or has it? The Great Depression of the 1930s stands out a huge deviation from this scenario, even at this height of observation. Also what is subtly missing from view is the gradual slowdown in trend growth especially since the 1980s. And a closer inspection of the blue line in the last six years reveals a distinct gap from the red line. And there appears to be no quick ‘return to normal’ (see my posts, http://thenextrecession.wordpress.com/2014/05/17/us-is-not-closing-the-gap-and-neither-is-the-uk/

and

http://thenextrecession.wordpress.com/2014/08/29/the-us-recovery-the-long-depression-and-pax-americana/).

Lucas noted this gap too. For him, the problem this time was that “government is doing too much,” and he specifically highlighted the “likelihood of much higher taxes, focused on ‘the rich’” and a “large increase in the role of government”. Well, none of those things happened except for the government bailing out the banks and the US economy still has not made up time from those ‘shocks’.

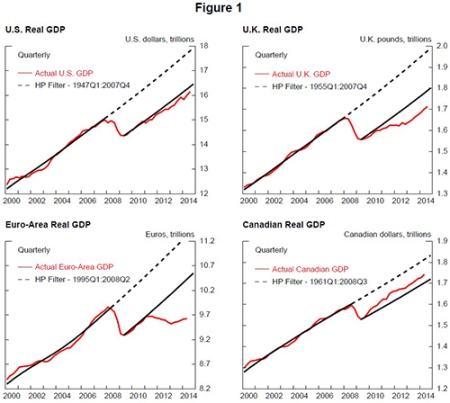

Recent research by economists Robert F. Martin, Teyanna Munyan and Beth Anne Wilson of the US Federal Reserve examined the experience of 23 countries since 1970 (http://www.federalreserve.gov/econresdata/notes/ifdp-notes/2014/potential-output-and-recessions-are-we-fooling-ourselves-20141112.html). They found that economic output doesn’t return to normal following a recession, especially a major one like the Great Recession.

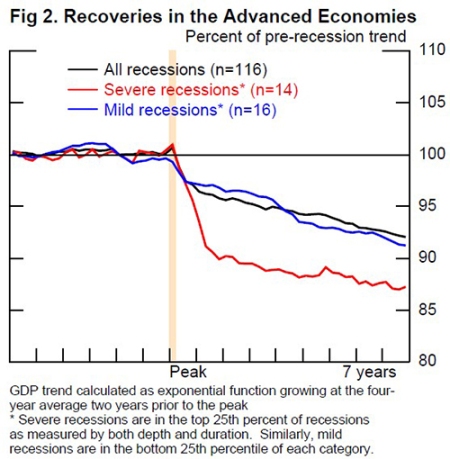

Indeed, the gap between potential growth and actual output just gets wider. As a result, the trend growth rate also falls as a consequence. As the chart below shows, a deep slump followed by a weak recovery steadily lowers the long-term growth rate in each successive year.

So there is no return to normal and there has been a permanent loss of value and output for the American people as a result of the housing bust, the global banking crash and the subsequent collapse in investment, incomes and employment.

According the Fed economists research, on average, GDP remains well below its previous trend, even for short and shallow recessions. On average, there is a permanent loss of output equivalent to nearly 15% of potential GDP growth in deep recessions more seven years later.

As the economists sum it up: “that recessions tend to depress the long-run level of output may imply that demand shocks have permanent effects. The sustained deviation of the level of output from pre-crisis trend points to flaws in the way the economics profession models the recovery of output to economic shocks and raises further doubts about the reliance on measures of output gaps to determine economic slack. For policymakers, the results also point to the cost of recessions, especially deep and long ones”.

So much for Robert Lucas’ confidence in recovery as long as governments don’t interfere. Slumps anyway have lasting damage: incomes, jobs and homes that can never be recovered. And right now that damage is still rising. It is another economic crime of capitalism.

2 comments:

Thank for your great work.

Can you let me know the reference or source of first graph ("ten global economic burdens....")

I want to use this for my presentation.

Same, if you look at the top of the article you will see the authors name, Michael Roberts. This will be a live link to the original article on his blog. I suggest you ask your question there and Michael Roberts will no doubt give you the source.

Post a Comment